💡 How I View the Stock Market – August 1st 2023

My last post ended with talk about how the current stock market is looking bullish. My prediction was correct and actually a little too tempered as price action has moved higher than I expected over the last month. My forecast predicted the market would consolidate just above or below $4,450 till the end of July, but instead the S&P currently sits just under $4,600 at $4,576.73. It is impressive how much the market has grown since last October.

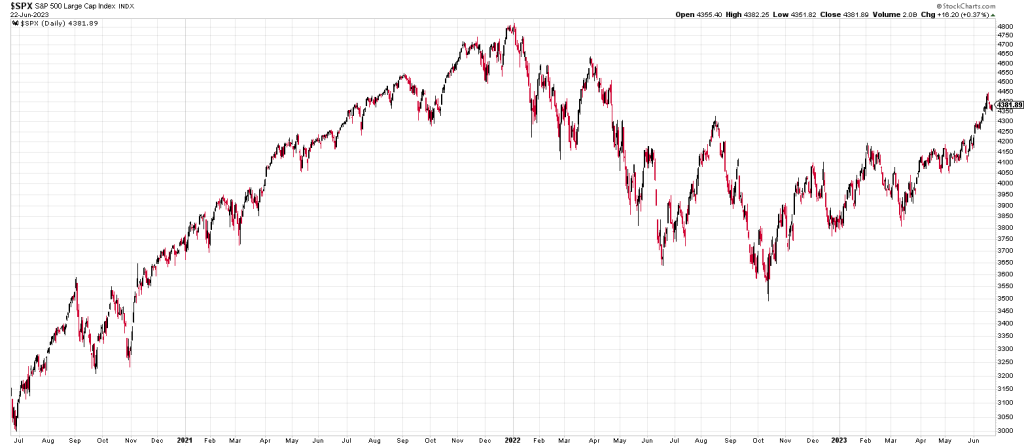

As you can see in the chart above, the S&P has several lines of support to fall back upon while continuing this uptrend. MACD, PMO, and AROON are all indicating positively too. It would take a real significant world event to break this trend.

Moving forward, I expect price action to continue hitting resistance at $4,600 for a short period like we’re currently seeing. As trendlines come up to meet price, we should eventually see price action breakout above $4,600 and move higher. I don’t have a firm understanding of areas of resistance above $4,600, so that’ll be a subject to explore further.

If price action breaks below $4,500, there’s the trendline currently at $4,400 that should provide support, but after that the next support does not come till $4,250 or $4,135 as a last resort. Hopefully a retraction of that magnitude would take more time to play out than will occur before my next post.

Overall, I think the market remains healthy. People are spending money. Companies are earning money. Rich people continue to get richer. Everyone is happy. I believe there is less appetite for bullish behavior than there was one month ago, but not by a whole lot. There still remains plenty of money to put into this market to keep it going up.

💡 How I View the Stock Market – August 1st 2023 Read More »