Last time I posted about the stock market I made two predictions:

- The market retraction that began in 2022 had ended in November/December.

- Price action on the S&P 500 would break out above $4,200 before late summer, but wouldn’t have the legs to go a lot higher.

About a month and a half has passed and my predictions both continue to stand as true.

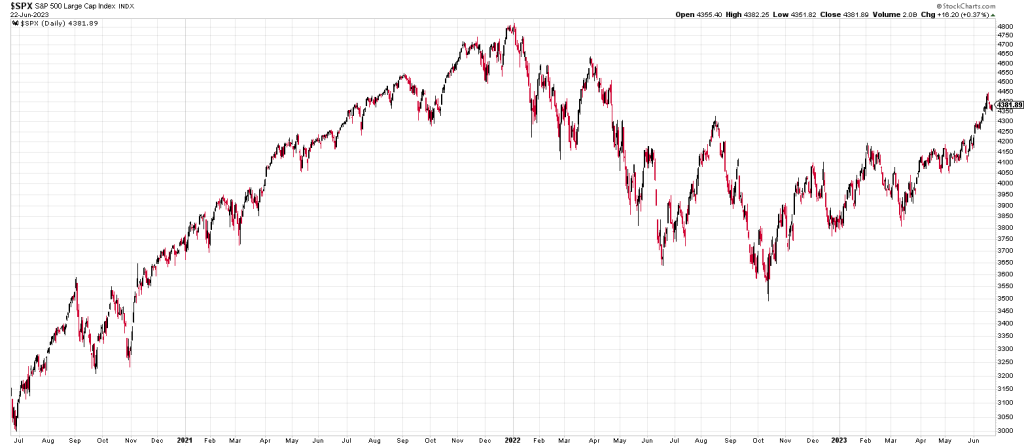

Looking at a 3-year daily bar chart for the S&P shows a very clear bottom to the downtrend from 2022. While at a 2-year perspective we remain in a slight downtrend, at the 1-year and 3-year perspective we are in an uptrend. When a trend turns 1 year old it’s officially a long term trend. This gives me confidence that my first prediction above will continue to be true for the foreseeable future.

My other prediction involved price action breaking out above $4,200. While I thought the market was not ready for notable upward movement, we only had to wait till the beginning of June to see the breakout. The move upwards encountered resistance at $4,450 instead of the $4,600 I predicted, but without a lot of history in this price area that kind of thing can be tough to call exactly. I am impressed by the bullish energy of the market and see no reason the trend will stop soon.

Moving forward, I believe the S&P will continue to make consistent gains. There should be firm support at $4,200-$4,300, so a breakout below that price would likely signal a significant change. If we see price action hold this support, it will be interesting to see whether $4,450 turns out to be mild or serious resistance. I suspect price will play back and forth in this area until possibly the end of July. General sentiment still feels like it’s waking up from the negativity of 2022 and there remain plenty of buyers out there. I see the current uptrend continuing to the end of the year barring any significant world events.