I believe the argument to repeal the increase in the California gas tax coming to the ballot this November is weak.

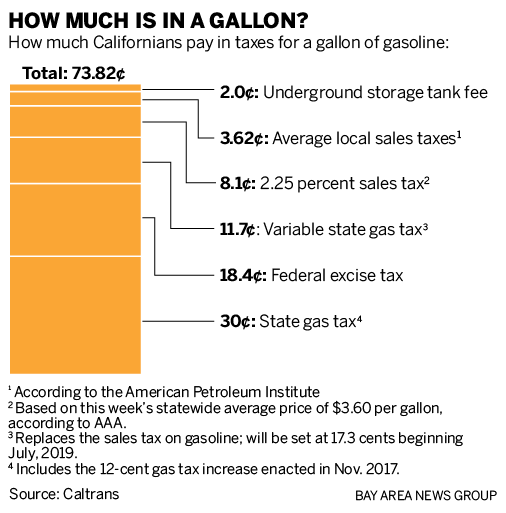

Currently, the state gas tax is 30 cents per gallon. Let us pretend that I drive a fair amount and put 300 miles per week on my car. If my car gets 25 miles per gallon, I need to put 12 gallons of gas in my tank each week. The state tax on 12 gallons of gas is $3.60. With this amount of driving, my contribution in state taxes totals $14.40 over four weeks, roughly one month. That’s essentially the cost of signing up for a family plan on Spotify.

While $15 a month does not sound like much to me, I understand how some families could be affected by that expense. At the same time, roads do not build themselves and there is a strong argument to be made that people who use roads should fund their maintenance.

However, Proposition 6 does not repeal the California gas tax. Prop. 6 instead repeals the 2017 increase of 12 cents per gallon. That’s what we are fighting over here. A mere 12 cents. If I run the same numbers from the pretend situation above but this time to calculate what Prop. 6 would save me, the total comes out to $5.76 per month.

Saving me $5.76 per month would mean roughly $50 billion over the next 10 years would no longer be available for state and local road programs, public transit, and traffic congestion improvements. The repeal is not worth that cost.

While California ranks near the top among states when it comes to tax on gas, the United States ranks only behind Mexico when it comes to countries with the lowest gas tax. When the U.S. first started building roads for automobiles, the tax on gas covered the expenses needed for construction and maintenance, but that is no longer true. Gas taxes and vehicle fees in the United States do not cover the expenses associated with our roads. But this is not a terrible situation.

Even if you and I do not drive, we receive a tremendous amount of benefit from our road networks. We live in a nation where access to goods and services is unrivaled anywhere else. In most urban and semi-urban locations, emergency services can be at our front door within 5 minutes. A well-maintained road network clearly benefits everyone.

In this age of extreme partisanship, it is important to recognize the spectrum of our positions so that we can come to fair conclusions that benefit society in the long run. It does not make sense for drivers to pay for 100% of our road network and neither does it make sense for them to pay an insignificant share. The answer lies somewhere in the middle.

From my position, driving is not taxed heavily enough considering the costs of road maintenance and the numerous other externalities it generates, climate change being a large one. I fear that Prop. 6 moves California even further away from the position where it should be when it comes to taxes on gas.